Purchasing Policy and Procedures Manual

Click here do download the PDF version

Table of Contents

- Authority

- Requirements – RUSO Policy

- Purchases

- Authorization

- Micro-purchases under Federal Financial Assistance Awards

- Bids and Board Approval

- Colleague Self-Service

- Accessing SE Colleague Self-Service

- Self-Service Finance Quick Guide

- Approval Path

- Submission of Accounts Payable Packets for Processing

- Partial Shipments

- Receipt of Damaged or Unsatisfactory Goods

- Returning Materials to Supplier

- Receipt of Merchandise Not Ordered

- Finance Office Audit Procedure Prior to Processing

- Purchasing Card Program

- Group Travel Advance

- Student Group Travel Card Policy and Procedures

- Travel Information

- Authorization for Out-of-State Overnight and International Travel

- Out-of-State Travel Instructions

- Out-of-State Travel Reimbursement (No Overnight Stay)

- Out-of-State Travel Reimbursement (Overnight Stay)

Authority

Purchases relating to public construction and improvement contracts are covered by the Public Competitive Bidding Act of 1974, 61 O.S. §101 et. seq.

The universities are exempt from the Oklahoma Central Purchasing Act (see 74 O.S. § 85.3), but are authorized to purchase all necessary supplies, materials, services, equipment, or other appropriate items subject to the following requirements:

Requirements – RUSO Policy Manual – Chapter 2.3 – Expenditures

https://docs.wixstatic.com/ugd/f17c8f_ef92dcafd20a46e9afdebb6360822723.pdf

2.3.1 Supplies, Materials, Services and Equipment

- All purchases must be for university purposes. Purchases which constitute gifts to a non-public or private entity are unauthorized.

- The university shall not make any expenditure which is prohibited by law.

- The value of a purchase equals the cost of an individual item or the cost of a bulk purchase of similar items from a vendor.

Split purchasing for the purpose of avoiding bidding or Board approval or notice requirements is prohibited.

Purchases relating to public construction and improvement contracts are covered by the Public Competitive Bidding Act of 1974, 61 O.S. §101 et. seq. - Bidding requirements do not apply to purchases made at or below the current pricing of: a state or federal contract; a state or federal governmental entity contract; an existing contract awarded by a state college or university, or an educational purchasing consortium contract. Professional services, as defined by Oklahoma Statutes (see 18 O.S. § 803), sole source or sole brand items, items placed by direct order with the prison industries of the Oklahoma Department of Corrections, and items which are statutorily exempt from bidding are not required to be bid.

2.3.2 Purchases of $ 50,000 or less

- A purchase of $ 50,000 or less is covered by university internal policies and procedures which may include formal bidding, informal quotation, or other prudent business practices.

- A purchase of $50,000 or less is not required to be reported to the Board.

2.3.3 Purchases exceeding $50,000 but not over $150,000

- A purchase exceeding $50,000 but not over $150,000 must be reported to the Board as an informational item.

- A purchase exceeding $50,000 must be competitively bid.

Bidding requirements do not apply to purchases made at or below the current pricing of: a state or federal contract; a state or federal governmental entity contract; an existing contract awarded by a state college or university, or an educational purchasing consortium contract. Professional services, as defined by Oklahoma Statutes (see 18 O.S. § 803), sole source or sole brand items, items placed by direct order with the prison industries of the Oklahoma Department of Corrections, and items which are statutorily exempt from bidding are not required to be bid.

2.3.4 Purchases exceeding $150,000

- A purchase exceeding $150,000 must have prior approval from the Board.

- A purchase exceeding $150,000 must be competitively bid.

A purchase exceeding $150,000 ($150,000.01 and more) must have prior approval from RUSO and must be competitively bid. Consult the RUSO policy or purchasing office for exceptions to this requirement.

A purchase in excess of $150,000 must have prior approval of the Regional University System of Oklahoma (RUSO). A “purchase” exceeds $150,000 in value when the cost of an individual item is more than $150,000, or when the cost of a bulk purchase of similar items from a given vendor is more than $150,000.

2.3.5 Sole Source Purchases

Each university may purchase from a sole source or sole brand only after reasonable efforts have been made to identify all possible sources. When purchases are made from a sole source, the university shall sign a sole source statement and document in writing the justification for the purchase from a sole source.

2.3.7 Exceptions

The following items are not required to be bid or reported to the Board:

- Library books and media

- Utilities

- University memberships

- State Risk Management premiums

- Aircraft and aircraft related parts

- Livestock

The following guidelines are presented to establish acceptable procedures to be followed when goods or services are to be purchased on behalf of Southeastern Oklahoma State University. These guidelines are written to conform to applicable Oklahoma Statues and Regional University System of Oklahoma (RUSO) policy. The intent of this guide is to assist university personnel in the procurement of goods and / or services, and to ensure that both the university and the vendor are protected in the process.

Purchases

When circumstances warrant or when it is in the interest of the University to grant an exception the Vice President for Business Affairs, or designee, may approve exceptions to these procedures.

University personnel who fail to follow these guidelines may be held liable for any unauthorized purchase.

Auxiliary operations, agency and trust accounts, and other agency special account operations may be exempt from these procedures. Questions regarding exemptions should be directed to the Vice President of Business Affairs Office.

Authorization

Each department has an established budget. The budget gives the department the authority to purchase goods and services within the limits of that budget.

Colleague Self-Service maintains approved signatures, which authorize expenditure of funds from a particular department or program. A purchase of $10,000.00 or more requires two authorizing signatures. A vice president, dean, or federal grant administrator has the option to require additional signatures of approval to purchase within their respective areas of responsibility. The President must approve any requisition exceeding $25,000.

Micro Purchases Under Federal Financial Assistance Awards

In accordance with statutory changes set forth in the National Defense Authorization Acts (NDAA) for Fiscal Years 2017 and 2018, memorandum M-18-18 raises the threshold for micro-purchases under Federal financial assistance awards to $10,000 and raises the threshold for simplified acquisitions to $250,000 for all recipients. Further, it implements an approval process for certain institutions that want to request micro-purchase thresholds higher than $10,000. Agencies are required to implement these changes in the terms and conditions of their awards, and recipients of existing Federal financial assistance awards may implement them in their internal controls. Please refer to OMB M-18-18 for additional information. OMB M-18-18 may be found on the Purchasing page under Additional Resources.

Bids and Board Approval

For all funding except Grants and other federally sponsored programs, a purchase of $25,000.00 but less than $50,000.00 ($25,000.00 to $49,999.99) must have 3 vendor quotes unless the purchase is state contracted. All information regarding quotes and contracts should be sent to Administrative Services for approval. The current VPBA, or designee, may grant an exception for purchases under $ 50,000.00 when properly documented and is within RUSO policies. Grants and other federally sponsored programs must adhere to the micro-purchase threshold of $10,000.

A purchase of $50,000 or more requires a formal bidding process. Departments must contact Administrative Services for instructions on bidding procedures. Exceptions may include utilities, professional services, aircraft and related parts, library resource materials, purchases from other state agencies, and others allowed by RUSO policy. Questions regarding an exception should be directed to the Administrative Services.

Bid specifications should be forwarded to Administrative Services with suggested vendors and the date the items are needed. Specifications should be received in Administrative Services a minimum of four (4) weeks before the order needs to be placed. Administrative Services will place all bids unless approval is given by Vice President of Business Affairs for the department to solicit the bids. A timeline of 14-21 days (14 days being the minimum days allowed) for advertising for non-Title 61 project will be used. Administrative Services must approve acceptance of any bid. In some cases, the low bid may not be the best bid. The reason for not accepting the low bid must be filed with the bid record.

- A purchase exceeding $150,000 ($150,000.01 and more) must have prior approval from RUSO and must be competitively bid. Consult the RUSO policy or purchasing office for exceptions to this requirement. A “purchase” exceeds $150,000 in value when the cost of an individual item is more than $150,000, or when the cost of a bulk purchase of similar items from a given vendor is more than $150,000.

Colleague Self-Service

Purchase Orders should be processed in advance of placing an order for purchases unless using the PCard. Prior approval is required for Purchase Orders.

Ongoing monthly expenses should be encumbered on a Requisition in Colleague Self-Service for the specified time period and dollar amount. Examples: rentals, custodial services, mentors, ongoing routine repair and maintenance.

Requisition (Purchase Order)

The principal means of communication between university departments and the Finance Office is through use of the Colleague Self-Service system. When a department wishes to purchase supplies, equipment, or services, a Requisition must be initiated by the respective department in Colleague Self-Service prior to placing order.

Requisitions may not be split to avoid a bid.

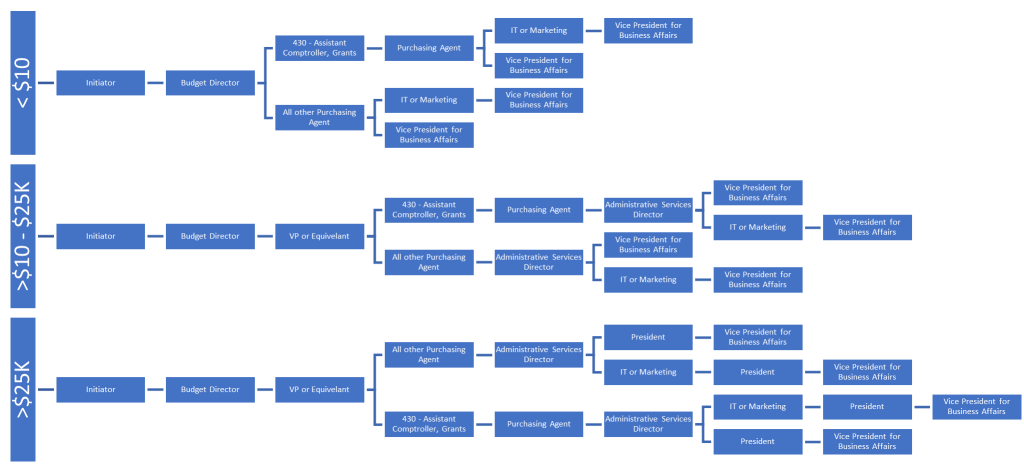

The electronic document will be manually routed for the required signatures including the Purchasing Agent (please see diagram on page 13 for approval paths). The Purchasing Agent will review and approve the Requisition. If a vendor requests an official copy of a purchase order, please contact the Purchasing Agent to request one.

Orders should not be placed by the ordering department until notice of the approved Purchase Order has been received. The purchasing office will retain the Purchasing Copy of the Purchase Order.

Colleague Self Service removes the dollar amount from the working available balance once the department initiates a document.

Receiving Goods

Accepting delivery of goods is the responsibility of the ordering department. It is the responsibility of the department to inspect all purchases, including opening and checking the contents. The department must determine whether the quality and quantity of the items purchased conform to specifications included in the Purchase Order.

The Colleague Self-Service initiator will certify receipt by receiving goods and services.

Blanket Requisitions

A blanket requisition authorizes unspecified purchases from vendors not to exceed a stated amount. Blanket requisitions must be issued for a stated period of time and a definite dollar amount. Purchases made against blanket requisitions should be limited to supplies or services of small dollar value. Equipment cannot be procured on blanket requisitions.

In the case that a purchase has been made before the Purchase Order has been approved it is the responsibility of the Colleague Self-Service initiator to put a note in the document. The note should state an explanation of why the policy of placing an order after the Purchase Order has been approved was not followed.

Orders should not be placed by the ordering department until notice of the approved Purchase Order has been received. The purchasing office will retain the Purchasing Copy of the Purchase Order.

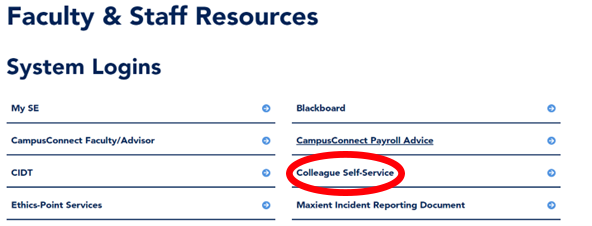

Accessing SE Colleague Self Service

Or you can log in to Colleague Self Service at Colleague Self Service.se.edu, using computer/email login information.

Self-Service Finance Quick Guide

Getting Started

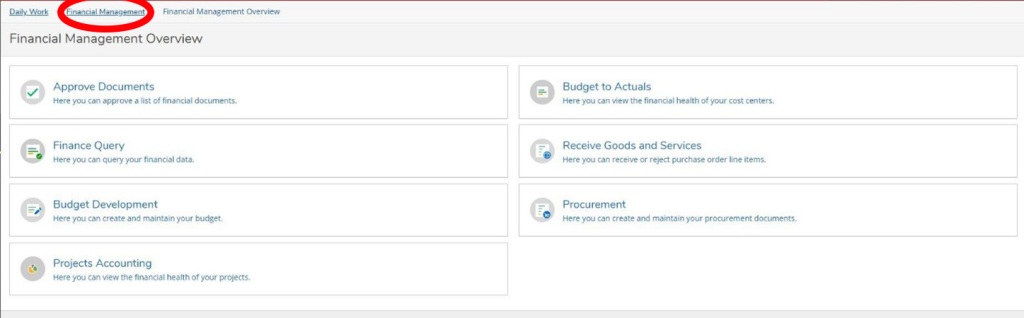

To get started, login to Self-Service and click on Financial Management tile. Based on user needs, access may not be granted to everything seen below.

Approve Documents

To get started, login to Self-Service and click on Financial Management tile. Based on user needs, access may not be granted to everything in this section.

- Click Approve Documents tile.

- Click Requisition Number or Journal Entry Number to drill down into details.

- Click the caret keys to drill into additional details on Requisition screen.

- Exit out of the requisition window to go back to the Approve Documents.

- Select the Approve box, enter Next Approver, and select Submit at the bottom of the screen.

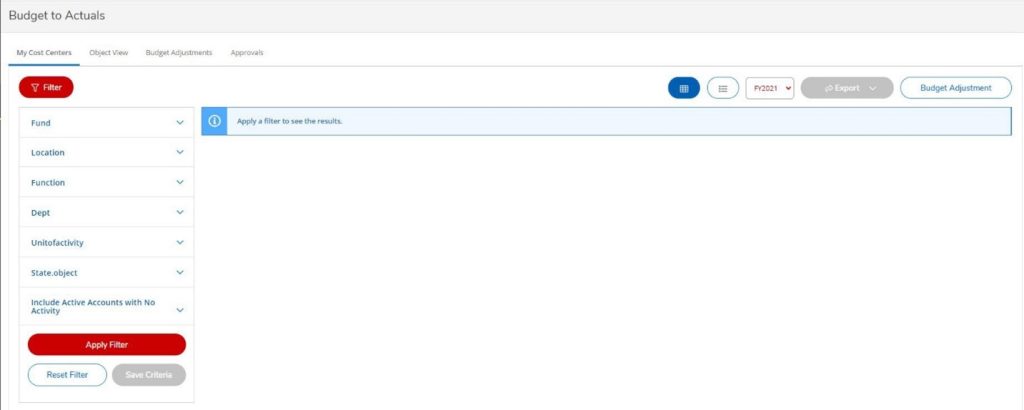

Budget to Actuals

Colleague Budget to Actuals in Self-Service enables users to see information about the cost centers for which they have access. The cost center information includes budget, actual, and encumbrance amounts for expense and revenue GL accounts. The cost centers sort in numerical order by cost center unit ID.

For each cost center, there is a bar graph displayed in the Bar Graph view, and there is a Financial Health indicator displayed in the List view. Bar graphs and indicators appear in different colors to represent whether a budget is underspent, close to being spent, or overspent. In the Bar Graph view, there is a bar graph for any revenue GL accounts included in the cost center, and a bar graph for any expense GL accounts included in the cost center. If there is only revenue or only expense GL accounts in that cost center, only the corresponding bar graph displays. In the List view, revenue cost centers do not have a Financial Health indicator, but expense cost centers do display an indicator.

In the Bar Graph view, if the revenue part of a cost center has a budget and there are no revenue transactions, the bar graph appears empty. As revenue transactions process, the bar graph will fill up with a teal color. If the expense part of a cost center has a budget and there are no expense transactions, the bar graph appears empty. As expense transactions process, the bar graph will fill up with a green color. After the expenses are over 85% of the budget, the bar graph will be yellow, and then it will be red when the budget is overspent.

In summary, under Budget to Actuals, you can view budget and expense reports, and process and/or approve budget adjustments.

To get started, login to Self-Service and click on Financial Management tile. Based on user needs, access may not be granted to everything in this section.

- Click Budget to Actuals tile.

- Use Filter to choose General Ledger Account Numbers or Projects to pull Budget to Actual information.

- This can be presented in My Cost Centers format or Object View.

- You can change the layout format, toggle between fiscal years using the drop- down box, export to Excel, or create a Budget Adjustment using the options across from the Filter button.

- Creating a Budget Adjustment

- Click the Budget Adjustment button.

- The Transaction Date and Initiator automatically populate.

- Type the Reason for the adjustment.

- Click Next.

- Enter budget adjustment information.

- Add From and Add To as needed.

- Click Next which takes you to a summary screen.

- Click the expand button by Approvers and enter Budget Director’s Approver ID (ex: CCHEEK) and select Add.

- Enter any additional notes in the Comments field.

- Click Submit.

- A window will pop up showing the budget adjustment was submitted successfully.

- The status of budget adjustments can be found under the Budget Adjustments menu.

Finance Query

Use the Finance Query to access financial data in Colleague Self-Service. The Finance Query is a reporting tool that works much like Budget to Actuals. This report can be run by a date range within a fiscal year whereas the Budget to Actuals is based on Fiscal Year to Date amounts.

Finance Query displays asset, liability, revenue, and expense accounts. You can sort data to see the GL account totals, sub-totals, and grand totals for more than one department. You can sort by a GL component or sub-component. You can select and apply new and existing default filters.

You can also produce a .csv file from the Finance Query screen.

To get started, login to Self-Service and click on Financial Management tile. Based on user needs, access may not be granted to everything in this section.

- Click Finance Query tile.

- Use Filter to choose General Ledger Account Numbers or Projects to pull financial transaction information.

- You can toggle between fiscal years using the drop-down box, run a specific date range, and export to Excel using the Finance Query.

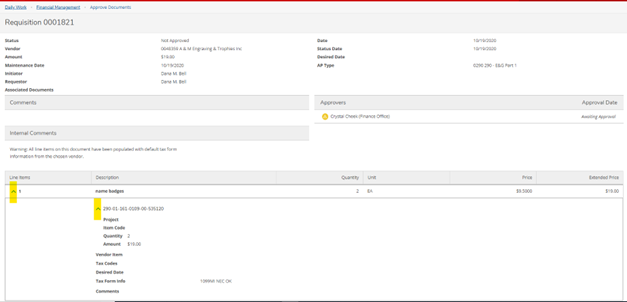

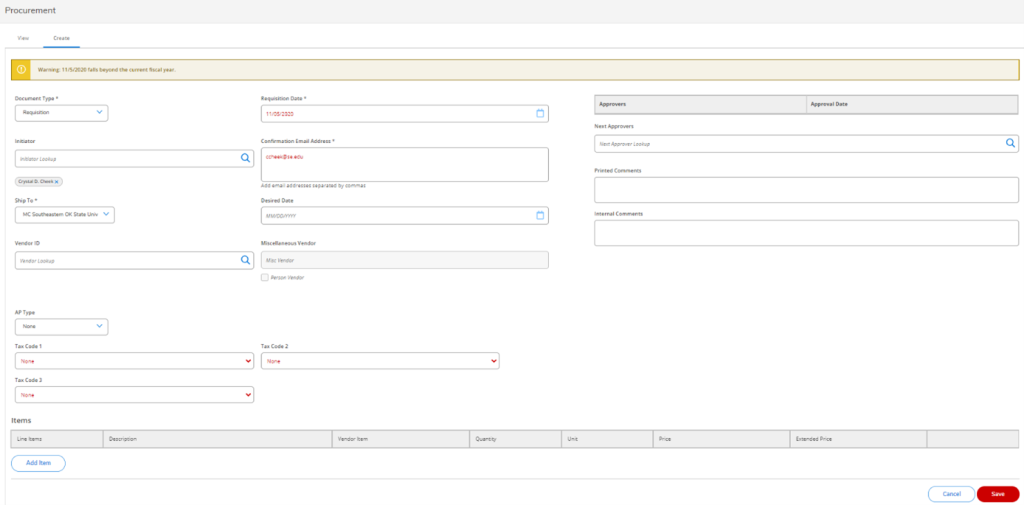

Procurement

Procurement is used to view and create requisitions, as well as view purchase orders. You can add as many line items as you need and add multiple GL account numbers to a requisition. You can enter Next Approvers and view the approver information on the Requisition. The Requisitions and Purchase Orders displayed are those for which you are either the requestor or the initiator.

To get started, login to Self-Service and click on Financial Management tile. Based on user needs, access may not be granted to everything in this section.

- Click Procurement tile.

- Under the View menu, it will show all Requisitions and Purchase Orders for the initiator.

- When the Requisition or Purchase Order number hyperlink is selected, it will show the details of the requisition or purchase order.

- The Create menu is used for requisition entry.

- Under the View menu, it will show all Requisitions and Purchase Orders for the initiator.

- Enter the requisition information, including Next Approver, and click Add Item.

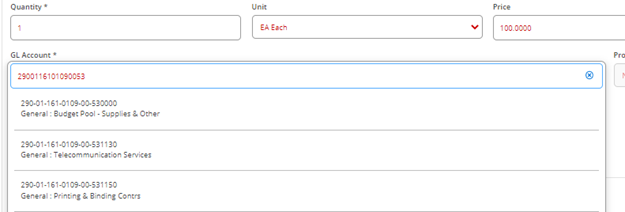

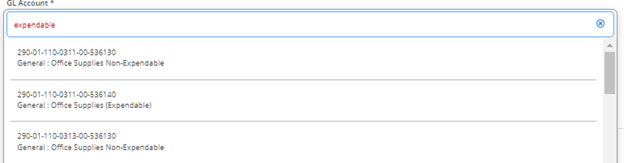

- Enter the item information. In the GL account you can either start entering the account string or you can search by description.

- Click Add Item.

- Click Add Item to add any additional lines, or if finished, click Save.

Projects Accounting

Projects Accounting provides budget and financial transaction information for users who have Projects in Colleague, such as Grants and Sponsored Programs.

Questions

For questions about this document, please contact the Finance Office or SE IT.

Approval Path

Submission of Accounts Payable Packets for Processing

- Login to Self Service

- Click Financial Management Tile

- Make sure the goods or services have been received appropriately through Receive Goods and Services. Items can be received directly from Procurement as well.

- Click Procurement Tile

- If you know the Requisition document number associated with your Purchase Order, click on the Requisition number.

- Click the Purchase Order document hyperlink under Requisition Overview

- Verify that the Status is correct

- On Status it should say one of the following:

- Accepted – All items have been received

- Backordered – Some items have been received

- If the status is Outstanding no items have been received on the Purchase Order. Items will need to be received before printing.

- On Status it should say one of the following:

- Click the caret symbol on the line items to show the detail

- Use Ctrl+P to pull up the print menu and click Print.

- If you don’t have the requisition number the caret symbol on the right side of Requisitions can be clicked to collapse the requisition list, which will show the Purchase Orders without having to scroll through all requisitions.

- Click on the Purchase Order Number that needs to be printed

- The Overview tab should show in the Purchase Order Details box on the right side of the screen.

- On Status it should say one of the following:

- Accepted – All items have been received

- Backordered – Some items have been received

- If the status is Outstanding no items have been received on the Purchase Order. Directly under the Purchase Order Details heading click the Receive hyperlink to receive the appropriate amount.

- On Status it should say one of the following:

- Click on the Requisition document hyperlink in the Overview information

- Click on the Associated Documents hyperlink to the Purchase Order

- Click the caret symbol on the line items to show the detail

- Use Ctrl+P to pull up the print menu and click Print.

- The Overview tab should show in the Purchase Order Details box on the right side of the screen.

- Accounts Payable Packets submitted to the Finance Office should include the following documents in listed order:

- Purchase Order page, with line-item detail

- Explanation if Purchase Order is dated after invoice date

- Explanation if invoice is submitted over thirty (30) days after invoice date

- If applicable to the purchase attach the following required documentation:

- Estimates, quotes, or bids

- Contracts for services

- Event information

- Flyer, brochure, agenda, invitation, or another event documentation

- Rosters

- Meal Expense Reimbursement Request for Approval

- Per Diem sheet or designated lodging verification for hotel direct pay

- Additional information such as packing slips

- Original invoice(s) in invoice number order

- If more than one invoice, run a tape and attach to front page of Accounts Payable Packet

- Register receipt type invoices should be taped to a blank sheet of paper

- Do not cut receipts that are too long. Tape only the top of the receipt and fold under.

- Do not highlight on register receipt type invoices. Highlighting wears away the ink, and when pulled in the future makes the invoices unreadable.

The Accounts Payable Packet should be forwarded without delay to the Finance Office to expedite payment.

Partial Shipments

It is the responsibility of the department to keep up with what amounts are left on a Purchase Order for partial orders. To close a purchase order and unencumber the dollar amount the initiator must contact the Assistant Comptroller.

Receipt of Damaged or Unsatisfactory Goods

If a shipment arrives with visible damages, the department employee should insist that the freight bills be noted “Received in Damaged Condition” and proceed with arrangements for an “Inspection Report” by the carrier’s representative. All boxes and packing materials should be saved until after the carrier has inspected. In case of damage made to a parcel post delivery, the local Postmaster should be contacted followed by written notice to the vendor with a copy sent to the purchasing office. Defective merchandise or substitute materials should be reported to the purchasing office by written memorandum. The memorandum should contain the department supervisor’s report of the complaint and suggestions of information sufficient to use as a basis for adjustment. The decision to accept an offer of adjustment must be mutually agreed to by the department supervisor and the purchasing office.

Returning Materials to Supplier

Goods MUST NOT be returned without first securing permission of the vendor. When return authorization is obtained, all shipping instructions should be followed, and all shipping labels or tags should be attached as directed by the authorization document. The requesting department should also send the vendor a letter of transmittal, which explains full particulars of each returned shipment, including date, requisition number, and name of carrier. A copy of waybill should be attached. Returns do not constitute a disputed charge. Disputed charges are strictly for unauthorized charges.

Receipt of Merchandise Not Ordered

If unordered or unidentified material is delivered, Administrative Services should be notified promptly since shipments are occasionally misdirected by vendors. Administrative Services will attempt to identify the department that placed the order. The University will accept no responsibility for merchandise received except when delivered in accordance with an official Purchase Order or PCard purchase.

With any of the above mentioned, please try to have situations resolved within a month if possible.

Finance Office Audit Procedure Prior to Processing

The Accounts Payable/PCard Specialist (all funds except 430) or Grants Specialist (430 funds) has the responsibility to check extensions and reconcile all invoices, review state object codes, and audit/verify documentation prior to processing invoices for payment.

PURCHASING CARD PROGRAM DESCRIPTION

The Southeastern Oklahoma State University Purchasing Card Program has been implemented to improve service to the university departments and to provide a more efficient process for small dollar purchases needed to conduct official University business. The Purchasing Card benefits SE and its departments through promptly paying vendors, reducing overall processing costs, and enabling purchasing from vendors who do not accept purchase orders.

The PCard will have no impact on your personal credit. Cards are issued in the name of Southeastern Oklahoma State University and include department name and a unique account number.

It is agreed that no policy and procedure guide can cover all possibilities. Exceptional cases will be resolved as circumstances and prudent business practices warrant on a case-by-case basis.

Definitions

Card Manager: Budget Director/DPS Approver

Card User: SE employee authorized to purchase goods using Purchasing Card once logged out from ‘Cardholder’ transferring responsibility to ‘Card User’

Cardholder: DPS Author authorized to purchase goods using their assigned Purchasing Card

Merchant Category Code (MCC): standard code that the credit card industry uses to categorize merchants based on the type of goods or services provided by the merchant. A merchant is assigned an MCC by the acquiring bank.

Split Purchasing: splitting or failing to consolidate a known quantity of goods or services for the purpose of circumventing (1) the Card statutory single transaction limit of less than $10,000 (including shipping & handling) per vendor per day and/or (2) spending limit(s) established for an individual Card and/or (3) a quotation/bidding requirement.

CARDHOLDER INFORMATION

Company/Organization: Southeastern Oklahoma State University

Forward Reconciled Statement of Account to: Finance Office, Accounts Payable/PCard Specialist,

Lost or Stolen Cards:

JPMorgan Chase 1.800.270.7760

Purchasing Office: 580.745.2132

Finance Office: 580.745.3324

PURCHASING CARD ADMINISTRATION

Accounts Payable/PCard Specialist

Finance Office

Administration Building Room 208

580.745.3324

- Responsibilities

- Month end audit of statements / invoices / assigned department number, state object code, and expense code / authorized expense

- Training of new cardholders

- Questions that arise related to:

- State object code

- Expense code

- Adding new department number

- Adding new expense code

- MCC codes

- Card is declined

- ‘Cardholder’ should review in PaymentNet reason card declined before calling

- Stolen / Lost Card

- Call JPMorgan Chase to report stolen / lost Card

- Follow up with an email to the Accounts Payable/PCard Specialist and dbell@se.edu

Dana Bell

Purchasing Agent/PCard Administrator

Finance Office

Administration Building Room 208

580.745.2132

- Responsibilities

- Purchasing Card Application

- Issuance of Card to Cardholder

- Return of Card due to termination or card expiration

- Issuance of new Card for expired cards

- Approval student travel airfare

- Stolen / Lost Card

- Call JPMorgan Chase to report stolen / lost Card

- Follow up with an email to the Accounts Payable/PCard Specialist and dbell@se.edu

Travel\Accounts Payable Specialist

Finance Office

Administration Room 208

580-745-2958

- Responsibilities

- Books faculty/staff airfare

- Assists faculty/staff with pre-paying registration

- Pre-pays registration when all requirements are met

- Books student travel airfare

- Reconciles Airfare and Registration PCards (monthly)

ISSUANCE OF THE PURCHASING CARD

SE Purchasing Card Application for the Purchasing Card is to be completed by the Budget Director/Department DPS Approver. Two signature approvals required: Card Manager (Budget Director) and Administrative Approval (Dean/AVP/VP).

The Program Administrator will set up the account and order the Card from JPMorgan Chase. Upon receipt of the Purchasing Card, the Program Administrator will notify the requesting department applicant to set up time for training and issuance of Card to applicant.

The Colleague Self-Service initiator will be the ‘Cardholder’ and must undergo training arranged by the Program Administrator in the Purchasing Office. The Purchasing Card Agreement must be signed at completion of training before card will be issued to the ‘Cardholder’ for departmental purchases. A copy of the signed Purchasing Card Agreement and a Policy and Procedure Guide will be given to the ‘Cardholder’ with other material deemed necessary by the Program Administrator.

The university credit card, referred to as the PCard or ProCard is an alternative form of small dollar purchasing. It is a JP Morgan Chase MasterCard. It is offered to departments and is authorized for purchases under 10,000, including shipping & handling. Larger purchases may be approved on a case-by-case basis and must have written approval from the Vice President of Business Affairs. The university is strongly encouraged to use the PCard for all possible small dollar purchases. The intention of the PCard is to lessen paperwork, pay vendors immediately, and allow the university to access vendors who do not accept purchase orders.

It is the Purchasing Card User’s responsibility to obtain transaction receipts from the merchant or vendor each time the Purchasing Card is used. These receipts must show that no tax was charged and must be itemized (a credit card receipt is not acceptable). It is the Card User’s responsibility to communicate with the vendor before a purchase is made, that SE is tax exempt.

Each week the card holder should code all transactions that have posted in PaymentNet. Each month before 5 working days have passed, the Card Holder will print a statement from the JPMorgan Chase web-based program. Each purchase requires the review of the card holder who will assign the correct general ledger account number to each purchase as well as the state object code in PaymentNet, a web-based program. Once the card holder has reviewed, coded, and approved each purchase, the budget director/card manager must review and approve each transaction. If they agree with the purchases, they should sign and date the statement. Statements should be separated by fund and sent separately with invoices attached.

A receipt for every item on the statement must be attached and the receipts must match the amount of the statement. Check receipts for tax. If tax was charged, vendor must be contacted, and credit secured – make a note in PaymentNet in the transaction notes box if charged tax and vendor will be crediting for that amount or the card user will be responsible for the unauthorized charges and paying the tax back to the clearing account with the Business Office. If the purchase is an unusual transaction, put a note in the transaction notes box.

Individual transaction receipts must be attached to the statement and submitted to the Purchasing Card Specialist in the Finance Office five working days from the first working day of the month. Log sheets (if applicable) need to be attached to the back of the statement. Failure to meet deadline could result in suspension or revocation of the Card and appropriate disciplinary actions. Policy violations may result in revocation of card privileges and possible disciplinary actions including termination.

Login to PaymentNet

During training ‘Cardholder’ will be given a login for PaymentNet, which will allow ‘Cardholder’ on-line access to reviewing and approving transactions. (see page 20 Cardholder On-Line Access to Reviewing / Approving Transactions)

PURCHASING CARD PROCEDURES

In addition to existing SE Purchasing Policy and Procedures, Oklahoma Statutes, and RUSO Policy, users of the Purchasing Card will be required to comply with the following procedures:

Authorized Items:

Only items/transactions less than $10,000.00 (including shipping & handling) per vendor per day and when in accordance with all existing policies, Oklahoma Statutes, and RUSO Policy are allowed. Purchases may not be split and charged to the Card to avoid the requisition requirements for pre-approval of expenditures of $10,000 or more. The card is not intended to be a tool to circumvent existing regulation.

Note: The Purchasing Card is especially suitable for supplies and materials, catalogue orders and payment for international purchases.

Travel (Airfare and Registration)

The Finance Office has credit cards for both airfare and registration related to travel authorized under the SE Travel Policy. These cards are authorized to charge airfare and pre-pay registration once the required signatures / approvals have been secured.

- Airfare – authorized to be paid through All Seasons Travel Agency with the approved Out-of-State Overnight / International Travel Request from. Purchasing airfare from a vendor other than All Seasons Travel Agency is prohibited at this time.

- Registration – Registration is authorized to be charged if required approvals have been secured on the Pre-Payment Approval Request Form

Card cannot be used for parking, baggage fees, cab fare, or purchase of food while in travel status.

Unauthorized Items Include but not limited to:

- Split Purchases

- Personal Use

- Sales Tax

- Cash

- Lodging not allowed on Departmental Cards

- Restaurants/Caterers/Food Service Vendors with the exception of Student Travel Cards

- Computer Purchases require a Purchase Order with approval from Help Desk with the exception of Mouse, Keyboard or Software that can be purchased off the shelf

- Gift Certificates / Gift Cards

- Auto Payments

- Licensing / Lease Agreements

- Conflict of Interest: cardholder should not purchase goods or services from a member of their immediate family or realize personal gain

- Mail / Postage

- Memberships

- Subscriptions

- Other purchases not permitted under SE Purchasing Policy and Procedures

Unless vendor does not accept a PO, or it has been pre-approved by the Purchasing Office.

Rebates, rewards, cash back and gifts with purchases may not be used for personal gain.

Spending Limits:

All purchases shall be less than $10,000.00 (including shipping & handling) per vendor per day, with the exception of utility payments and Student Travel Card charges. Departments may set limits less than that amount if they wish. Requests must be made to the Program Administrator in the Purchasing Office.

USE OF THE PURCHASING CARD

The Card may be used in person, by phone, internet, etc…

Ship to address to be used for all orders:

Southeastern Oklahoma State University

ATTN: (Card Username) or (Department Name)

425 W University Blvd

Durant, OK 7470-3347

All purchases are tax-exempt. It is the responsibility of the Card User to inform the vendor that the transaction is tax exempt prior to making the purchase.

Responsibility of Card User, Cardholder, Card Manager

It is important to ensure that the Purchasing Card is neither deliberately nor inadvertently used for personal or other prohibited transactions. It is also important that the Purchasing Card is not used in excess of budgeted funding. It is the responsibility of the Cardholder to monitor the purchasing card process.

Purchase in Person: Check receipts before signing the charge slip. If tax charged ask vendor to remove tax before completing the transaction and signing the charge slip.

Purchase by Phone / Internet: It is the responsibility of the ‘Card User’ to inform the vendor that SE is tax exempt prior to placing order. If tax is charged, the ‘Cardholder’ has the responsibility to contact the vendor and request that a credit for the tax be applied back to the card. Card User is responsible to reimburse SE for unauthorized charges and tax charged on Purchasing Card. The ‘Cardholder’ is responsible for ensuring receipt of supplies and materials and will follow up with the supplier to resolve any delivery problems. If materials are ordered by phone, ask the supplier to include a sales receipt (itemized) in the package. Save the credit card receipt and shipping documentation.

Cardholder to Card User Responsibility

In certain situations, the ‘Cardholder’ is allowed to sign out the Purchasing Card to a SE employee. ‘Cardholder’ must maintain a log where the ‘Card User’ must sign and date the card out and sign and date the card in. No proxy signatures will be allowed. ‘Card User’ is responsible to reimburse SE for unauthorized charges and tax charged on Purchasing Card.

It is the responsibility of the ‘Card User’ to inform the vendor that the transaction is tax exempt prior to placing order. A copy of SE’s Tax-exempt permit is available to provide to vendors on the Purchasing webpage. The ‘Card User’ is responsible to reimburse SE for unauthorized charges and tax charged on Purchasing Card.

The ‘Card User’ is responsible for ensuring receipt of materials and will follow-up with the supplier to resolve any delivery problems. If materials are ordered by phone, ask the supplier to include a sales receipt (invoice) in the package. Turn in original credit card receipt(s) and shipping documentation to the ‘Cardholder’.

Cardholder On-Line Access to Reviewing / Approving Transactions

As transactions occur, the ‘Cardholder’ will reconcile the credit card receipt (itemized invoice) to transaction in PaymentNet by reviewing individual transaction receipt (tax exempt), assigning funding (GL account number), and assigning a state object code(s) in PaymentNet.

Every month, usually on the second day of the month, the ‘Cardholder’ will print a ‘Statement of Account Portrait’ from PaymentNet and reconcile transactions to original receipts. Individual transaction receipts (itemized invoice) must be attached to ‘Statement of Account Portrait’ in order listed. Reconciliation (statement of account portrait must be signed / dated by both the Card Manager and Cardholder with original itemized receipts attached in order listed) is due in the Finance Office on or before the 5th calendar day of the month. Failure to meet deadline could result in revocation of the Purchasing Card and appropriate disciplinary action.

Grants and Contract Accounts

Use of the Purchasing Card for purchases under sponsored agreements must fall within the guidelines, both scope and budget, of the sponsored agreement and SE Purchasing Policy and Procedures. The ‘Cardholder’ must note the Project IDin PaymentNet.

Disputed Transactions

The ‘Cardholder’ or ‘Card User’ must settle all disputes with the vendor involved. The Accounts Payable/PCard Specialist in the Finance Office can assist in any unresolved disputes if necessary.

If a credit refund is to be issued, the ‘Cardholder’ is to request that vendor issue a credit to the appropriate Purchasing Card account.

Termination/Cancellation of the Purchasing Card

The Purchasing Card is valuable property which requires proper treatment by the Card User, Cardholder, and Card Manager to protect it from misuse by unauthorized parties. The Purchasing Card may be cancelled immediately if the department does not comply with the policy and procedures.

Expiration Date

The Purchasing Card is automatically terminated at the end of the expiration date indicated on the card. JPMorgan Chase will send new card(s) to the Finance Office. The Purchasing Agent/PCard Administrator will contact the ‘Cardholder’ when the new card arrives. The ‘Cardholder’ will turn in the expired card at time new card is issued.

Terminated or Transferred Employee(s)

If the ‘Cardholder’ is terminating or transferring to another department the ‘Cardholder’ should contact the Purchasing Agent/PCard Administrator in the Finance Office and return the Purchasing Card in their possession prior to departure. If ‘Card Manager’ is terminating or transferring, the ‘Card Manger’ should contact the Purchasing Agent/PCard Administrator in the Finance Office to note a change in approval path. The ‘Cardholder’ should also ensure notation has been made for a change in approvals.

Lost/ Stolen Cards

If the Purchasing Card is lost or stolen, please contact JPMorgan Chase immediately, 24 hours a day at 1-800-270-7760. Also contact the Purchasing Agent/PCard Administrator in the Finance Office at 580-745-2132 or Accounts Payable/PCard Specialist in the Finance Office at 580-745-3324.

Declined Cards

If ‘Cardholder / Card User’ is at vendor location and unable to access PaymentNet:

Contact the Accounts Payable/PCard Specialist in the Finance Office at 580-745-3324. They will login to PaymentNet and determine the reason for the decline. In some cases, the problem can be fixed while you are still with the vendor and the vendor will then be allowed to rerun the transaction.

If ‘Cardholder / Card User’ is able to access PaymentNet:

Login to PaymentNet and determine the reason for the decline. If MCC problem, contact the Finance Office Administrator (PCard) to assist with the problem. Then the vendor will be allowed to rerun the transaction.

Some declines will be valid and will not be able to be corrected.

Common reasons for a decline include:

Vendor MCC (Merchant Category Code) not activated

Amount exceeds daily spending limit

Transaction exceeds daily transaction limit

Amount exceeds transaction dollar amount limit

COMPLIANCE AUDITS Finance Office staff are responsible for reviewing / auditing month end reconciliations for adherence to policy as stated. Misuse of the Purchasing Card in any manner by a Card User, Cardholder, or Card Manager may result in revocation of the privilege to use the card, disciplinary action, termination of employment, and/or criminal charges being filed with the appropriate authority.

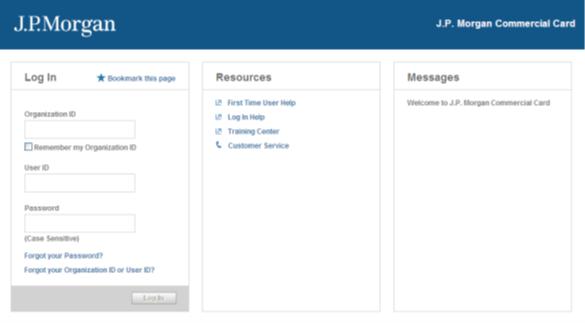

Logging in to PaymentNet

1. Using your Internet browser, go to the following address:

. Enter the following on the PaymentNet Log In screen:

• Organization ID: Enter your Organization ID

• User ID: Enter your User ID

• Password: Enter your Password

Note: If you are unsure of your Organization ID, please contact your

program administrator. Your password is case sensitive.

2. Select the Remember my Organization ID checkbox. PaymentNet

saves your organization ID so you do not have to enter it each

time you log in.

Note: J.P. Morgan discourages selecting this option if you are

accessing PaymentNet from a public computer.

3. Click Log In

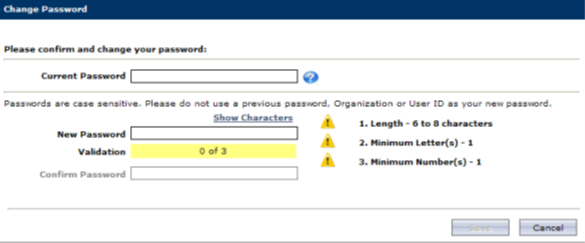

Changing Your Password

1. Select the My Profile icon from the main menu.

2. Click the Change Password link.

3. Enter your Current Password.

4. Enter and confirm the New Password. Passwords are case

sensitive and must conform to the password constraints that

display to the right of the fields. 5. Click Save

Viewing Transactions

There are three ways to find and review transactions.

Locate transactions from the transaction list: select Transactions >

Manage. The Transaction List screen displays transactions for the

last 30 days.

You can also find transactions using an existing (saved) query:

select Transactions > Manage, and select an existing query from the

drop-down list next to the Set as Default Query link.

A more specific way is to locate transactions based on the criteria

you define by creating a new query. Finding a transaction this way

locates just those transactions you need.

Follow the steps below to create a new query to view transactions.

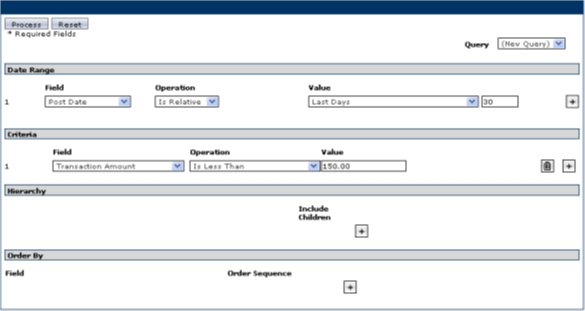

1. Perform a new query to locate the specific transactions. Select

Transactions > Query.

2. Enter your date range:

• Field: You can select Post Date or Transaction Date from the

drop-down list.

• Operation: Select the criteria to measure the field value. The

operations that display vary based on the selected Field. For

example, Is Relative is a relative date range or a period of

time that is relative to the current date, e.g., Last Week is a

relative date range.

• Value: Enter or select the value in the appropriate boxes.

Dates should be in the MM/DD/YYYY format

.

3. Enter your criteria:

• Field: Available fields are listed in alphabetical order. Select

a field from the drop-down.

• Operation: Select the criteria to measure the field value. The

operations that display vary based on the selected Field.

• Value: Enter or select the value in the appropriate boxes.

Dates should be in the MM/DD/YYYY format.

Note: To improve query results, enter the minimum amount of

characters for the criteria value to identify text fields. For

example: enter “Banana” instead of “Bananas,” “Banana’s,”

“Bananas, Inc.” or “Banana Store #2342.”

4. If additional rows of criteria are needed, click the Plus icon.

To delete a row of criteria, click the Trash Can icon.

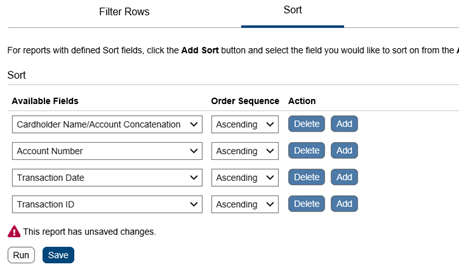

5. In the Order By section, set the data columns in a specific order:

a. Click the Plus icon.

b. Select the Field.

c. Select the Order Sequence.

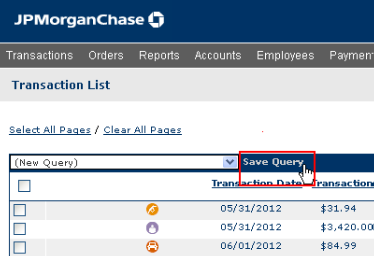

6. Click the Process button to run the query. Query results display

on the Transaction List screen.

7. Click the Save Query link located next to the default query drop-down list.

8. Enter the name you want for this query in the text field.

9. Click Save. The saved query is now available from the Save Query drop-down list.

10. Click the transaction you want.

11. On the Transaction Detail screen, select the appropriate tab to view additional information:

• General Information. Manage transaction details such as approving transactions, entering tax information, and applying accounting codes.

• Receipts. Attach or fax receipts if your organization has Receipt Imaging enabled.

• Addendum. Review details such as a tracking number associated with an order and the anticipated delivery date.

• History. Review additional transaction audit data.

Note: Additional information on transactions may be available if

icons are displayed on the Transaction List. Click the icon to view the detail.

Disputing Transactions

You can dispute a charge to your card account. For example, if you

have an incorrect charge, a billing error, or if the merchandise you

received is not as described, you can dispute it.

Note: Before disputing a transaction, you must first attempt to

resolve the issue directly with the merchant.

1. Select Transactions > Manage.

2. On the Transaction List screen, click the transaction to dispute.

3. On the Transaction Detail screen, click Dispute.

4. Confirm your E-mail Address.

5. Select the Dispute Reason from the drop-down list. The system

refreshes and might require additional field input.

6. Enter any additional information, if necessary.

7. Click Submit.

Note: Track the status of your dispute online on the Transaction List.

Red Square = Dispute in Process

Yellow Square = Dispute Submitted

Green Square = Dispute Resolved

Click the colored squares and follow the steps to cancel or

resolve your dispute.

Setting Up Your Monthly Report (Statement)

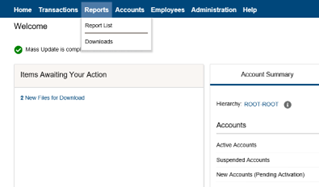

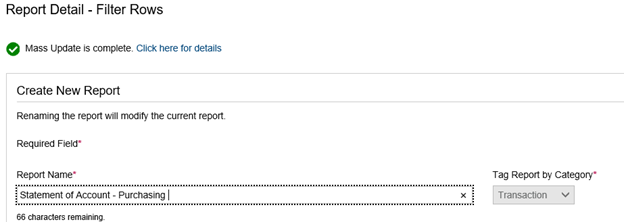

These are procedures on how to set up your Statement of Account. After you complete this process, you will only need to change the cycle dates each month. This report will need to be run after all approvals have been applied. You will need to run this report and turn it in with receipts attached. The cardholder and card manager will sign the bottom of report.

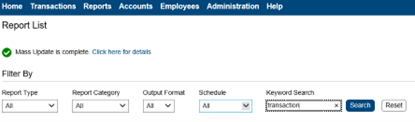

Under the Reports Heading click Report List

Type in transaction in the Keyword Search then click Search

- Search for Statement of Account Portrait and click on it

Rename the Report by taking out the word Portrait and adding either the last four digits of your card or your card name

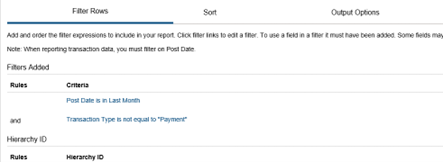

Under Criteria click on Post Date is in Last Month

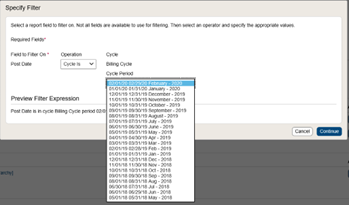

Change the Operation to Cycle Is and choose the current Cycle Date the click Continue

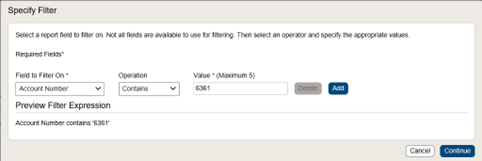

Under Criteria click the Add button on the Right of Transaction Type is not equal to “Payment” then click [Add a Filter Criteria]. Change the Field to Filter On drop down to Account Number, The Operation to Contains and the Value to the last four digits of your card. Then click Continue.

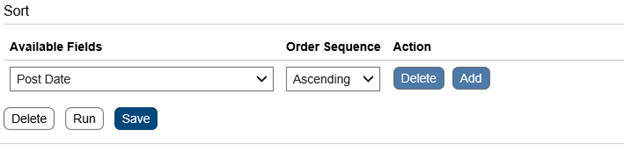

Click on the Sort field and under the Action column delete any three of the four choices.

Change the Available Fields on the remaining one to Post Date then click Save

If you have multiple cards you will need to run through this process for each card. Now that you have completed the statement set up each month you will only need to change the Cycle Date to reflect the correct month. Each month you will run the report as follows

- Click on Reports

- Report List

- Find the report you set up and click on it

- Click on the Post Date is in cycle Billing Cycle

- Click on the correct Cycle Period

- Click Continue

- Click Run

- Click Reports

- Click on Download

- When the Status changes from Submitted to Successful click on the Statement of Account under the Output heading (should end in .zip).

- Double click the Adobe document and print off your statement

2.2 GROUP TRAVEL ADVANCE

A Student Group Travel Advance can be requested in Colleague Self-Service by entering a requisition. Advances will be processed through accounts payable after an Accounts Payable Packet including a Student Travel Cash Advance form and event documentation is submitted to the Finance Office.

The university utilizes student activity revenues in funding student-related trips. The universities are authorized to advance these funds to a faculty sponsor or sponsoring coaches. The funds must be used only for travel, transportation, food, lodging, and/or other trip-related expenses in the exact amount of the actual and reasonable expenditures that were incurred. The unused portion of the funds advanced for a trip must be returned to the institution upon the trip’s completion. A reconciliation of expenses incurred during the trip must be prepared by the sponsor within a reasonable time (7 working days) after the completion of the trip.

Requirements – RUSO Policy Manual – Chapter 2.2 – Group Travel Advance

STUDENT GROUP TRAVEL CARD POLICY AND PROCEDURES

Student group travel credit cards are authorized for student group travel only. To obtain a credit card for student group travel, it will be necessary to check out a Student Group Travel Card. Expenses authorized on the cards will be student meals, lodging, onsite registration, admission, transportation, and certain miscellaneous expenses. Other expenses authorized on the card will be Coach/Sponsor meals and lodging only when accompanying students who are participating in authorized student activity travel. Coach/Sponsor must stay at the same hotel and eat at the same restaurant with students.

Violations of this policy may result in action from suspension of the card, to “write-up” attached to personnel file to loss of job and/or criminal prosecution.

- Coach or Sponsor must fill out Part 1 of a Student Group Travel Card Request Form

- Coach or Sponsor will estimate expenses for the trip and sign the form and obtain the signature of the Budget Director. Coach or Sponsor will submit the form to the Card Holder.

- The approval signatures signify approval of the funding and expenditure for the trip.

- Card Holder will review estimated costs to make sure there is available budget to cover the trip. The Card Holder will review form to make sure approval has been obtained.

- The Card Holder will log out the credit card to the Coach/Sponsor. Coach/Sponsor must sign the log to transfer responsibility of the card.

- Coach/Sponsor MUST keep all itemized receipts of expenditure to turn in with trip reconciliation.

- It is the Coach/Sponsor’s responsibility to obtain transaction receipts from the merchant or vendor each time the Student Group Travel Card is used. These receipts must show that no tax was charged. It is the Coach/Sponsor’s responsibility to communicate with the vendor before a purchase is made, that SE is tax exempt.

- A roster of students who participated in the trip and faculty/staff who participated in the trip must be included with reconciliation.

- Reconciliation will consist of:

- Completed Student Group Travel Card Request Form

- All receipts to back up charges claimed on the form must be attached to the back of the form.

- Participant roster must be attached to the reconciliation which must include the names of the students who went on trip.

- Part 2 of the Student Group Travel Request Form must be filled out.

- Signatures of Coach/Sponsor must be on bottom of the form

- No personal items can be charged to the Student Group Travel Card.

- It is the Coach/Sponsor’s responsibility to stay within budget for the student group travel. If the pre-approved budget for the trip is exceeded, the sponsor may be responsible for the amount that exceeds the approved request.

- The Coach/Sponsor will reconcile the Student Travel Card Request Form and attach all receipts, rosters of students who attended the event. The completed form will be signed by the coach/sponsor and by the Budget Director/Card Manager.

- The completed form and the credit card will be turned in to the Card Holder upon returning from the trip.

- The Card Holder will verify the reconciliation.

- Check transactions for accuracy and compliance.

- Add state object code and charge out transactions in

Payment Net to correct GL account number.

- Verify that all trip transaction receipts are attached to the Student Group Travel Card Request Form.

- Verify all approval signatures.

- Verify that there is adequate budget to cover the expense before sending the reconciliation to the Purchasing Office with the PCard statement.

- Meal receipts must show items purchased.

- Reimbursing a Coach/Sponsor for out-of-pocket expenses:

- Fill out the SPONSOR REIMBURSEMENT FOR OUT-OF-POCKET EXPENSESportion of the form

- Attach receipts for out-of-pocket expenses to a copy of the form.

- If no receipts are available, a Missing PCard receipt form (Exhibit G), signed by the Coach/Sponsor & Budget Director/Card Manager must be attached describing the expense.

- The copy of the Student Travel Card Request Form with the request for Coach/Sponsor reimbursement must be signed by the Budget Director/Card Manager.

- Copy of the form and receipts must be presented to Business Services for reimbursement.

The student/sponsor ratio should be 5/1. Tips and gratuity should be no more than 20%. Anything over 20%, unless automatically added by vendor, will be the paid out of pocket.

TRAVEL INFORMATION

Official Business Travel – General Rules

The Southeastern Oklahoma State University Travel Policy has been developed in accordance with Oklahoma State Statutes, and the Office of Management and Enterprise Services’ Statewide Accounting Manual. Employees on official travel for the state may be reimbursed for authorized and approved travel expenses essential to the transaction of official business. Other persons who are not state employees, such as volunteers, students, etc., who perform substantial and necessary work or service for the state may also be reimbursed for expenses incurred during official, authorized travel.

All travel claims for reimbursement for travel expenses must be submitted on approved Travel Information Claim Form with expenses itemized. Payment shall be subject to the availability of the amounts in the agency’s budget. The traveler is responsible for preparation and submission of their travel information claim form. Proper completion of all pertinent information fields is essential for prompt payment. Incorrect or partial completion of any of the required information risks rejection of the claim resulting in delays in the payment of expenses.

To expedite payment for reimbursement of expenses attach all required documentation and secure all the proper signatures. If you have problems printing, go to “Page Setup”, and adjust the scaling on the “Page” tab. The employee must clearly state the purpose of travel or “Nature of Official Business” on the travel information claim form. The statement of purpose of travel should be concise, but clear enough that a person apart from the agency may understand the precise nature or purpose of the trip. For example, indication of “Meeting” for “Nature of Official Business” is too vague of a statement to convey the clear purpose of travel. A notation or statement, such as “Attend Office of State Finance Meeting on Travel Claim Preparation, May 3-5, 2016” provides a better and more useful description of the purpose of travel. Each point of travel (including en route stops for lodging) with its location (e.g., city and state) and the exact date and time of starting and ending overall travel must be shown on the claim form. This information is required in part to verify the use of the most direct route in travel.

An employee may be reimbursed only for expenses he/she personally incurred and is entitled to claim. Paid receipts or other evidence of payment must be provided for each expense item for which a receipt is required as the basis of payment (e.g., lodging, registration, tolls, parking, other actual and necessary expense items)

Specific policies which apply to various types of travel expenses are listed on the next several pages. If you have any questions about travel forms or guidelines, call the Travel Specialist in the Office of Finance (ext. 2958). Travel Information Claim Form should be reviewed by someone other than yourself prior to sending to Office of Finance for processing to ensure that all required documentation is attached, and all signatures have been secured.

Employee’s Responsibility

Employees traveling on official business for the state are expected to exercise the same care in incurring expenses that a prudent person would exercise if traveling on personal business. Excess costs, circuitous routes, luxury accommodations, and services unnecessary or unjustified in the performance of official business are not acceptable and should be avoided as a standard practice.

Persons performing official travel as authorized by their agency are responsible for the preparation and submission of their travel voucher, although the agency should assist in such preparation when appropriate and/or provide training in the process. The traveler should obtain appropriate receipts for all applicable charges and keep a personal record of miscellaneous expenditures chargeable to the state, noting each item as the expense is incurred. In this way, all necessary information will be accumulated and available for preparation and submission of the travel voucher.

All expenses claimed for reimbursement must be fully denoted and properly declared under the appropriate section of the travel voucher. Reimbursable travel expenses are confined to those expenses that are essential to the transaction of official business in connection with the purpose of travel (i.e., “nature of official business”) as indicated on the travel voucher.

The employee’s signed affidavit affirms that all travel was performed as indicated and that the voucher for reimbursement represents a true and correct account of travel and related expenses. It is further implied from the traveler’s signature that any expenses claimed have not been reimbursed or otherwise provided for by other sources. This includes the certification that “No frequent travel miles earned from any official state transportation have been used for personal transportation purposes.” By their signature on the affidavit, the employee is held liable under possible penalty of law for any falsified expense or misstatement of voucher. (74 O.S. § 500.15)

Travel Information Claim Form – required information for in state and out-of-state travel

- Claimant: Claimant’s Name

- Vendor Number

- If you have not been set up with a Colleague Vendor Number, please contact the Travel/Accounts Payable Specialist ext. 2958 to request your new vendor number.

- Address

For ALL University Employees the address with be 425 W University Blvd, Durant, OK 74701

- Account Number/Account Name/Limited $ Amount

- 3 lines for account numbers and account names (example: 290-01-110-0502-00 Organized Research)

- If limited funding, include limited $ amount

- Is Claimant a State Official or Employee?

- Mark “Yes” or “No”

- Do Not leave blank

- Official Duty Station

- Physical Address Where Assigned Office is Located

- Do Not leave blank

- Is Claim Limited to Funding?

- Mark “Yes” or “No”

- If “Yes” fill in $ amount

- Mark “Yes” or “No”

- Misc/Overnight Costs – No Cost Reimbursement (Informational Only) – top left-hand side of form

- Informational Only – Not to be included in the Reimbursement Cost Section

- Information is required for travel expenses paid by SE Purchase Order or PCard

- Enter Registration Paid and Purchase Order Number or PCard (month)

- Enter Lodging Paid and Purchase Order Number or PCard (month)

- Enter Airfare Quote booked thru All Seasons Travel and Requisition Number (found on email sent from Office of Finance staff)

- Vehicle Used (Required)

- Mark “Personal” “University” or “Passenger”

- If “Personal” or “University”

- Tag Number – Required for both University and Personal vehicles

- If “Passenger”

- List Driver

- If “Personal” or “University”

- Mark “Personal” “University” or “Passenger”

- Is Claim for Overnight Travel?

- Mark “Yes” or “No”

- If “Yes” complete “Lodging” and “Per Diem” sections – page 2

- Mark “Yes” or “No”

- Nature of Official Business

- The employee must clearly state the purpose of travel or “Nature of Official Business.” The statement of purpose of travel should be concise, clear enough that a person apart from the agency may understand the precise nature or purpose of the trip. Indicate “Attend” or “Present” or “Sponsor”

- For example

- Attend Office of State Finance Meeting on Travel Claim Preparation Conference, May 3-5, 2021 in Orlando, FL

- For example

- Do Not abbreviate

- The employee must clearly state the purpose of travel or “Nature of Official Business.” The statement of purpose of travel should be concise, clear enough that a person apart from the agency may understand the precise nature or purpose of the trip. Indicate “Attend” or “Present” or “Sponsor”

- Each point of travel (including in route stops for lodging) with its location (Name of Destination and physical address) and the exact date and time of starting and ending overall travel must be shown on the claim form. This information is required in part to verify the use of the most direct route in travel.

- Beginning and Ending Travel – “Date” and “Time”

- Enter actual Beginning Date and Time and Ending Date and Time

- Point Travel Begins and Ends

- Enter City travel begins, and City travel ended

- If leaving from or returning to home during work week (Monday thru Friday) – The shorter of the distances from the employee’s residence or office location to the destination point(s) of travel would be considered the starting point of travel

- If home is shorter make notation in the mileage section -*home is shorter distance

- If leaving from or returning to home during weekend or holiday – Distances from the employee’s residence to the destination point(s) of travel would be considered the starting point of travel and/or ending point of travel

- If home is starting point of travel and/or ending point of travel, make notation in the mileage section -*weekend – left from home and/or returned to home

- All Points Visited

- List “All Points Visited” in order traveled

- Be specific in points visited

- If visiting public schools, please note the official school name

- Broken Bow Middle School or Rector Johnson Middle School – it is important to be specific to verify correct physical address

- If visiting public schools, please note the official school name

- If space is available list the physical address of each point visited

- Examples:

- DFW to Las Vegas, NV to DFW

- Hugo Library to Idabel High School to Valliant High School to Rock Creek High School

- Silo High School 122 W Bourne St, Durant, OK to Madill High School 700 S 5th Ave, Madill, OK

- Examples:

In State Travel Reimbursement (No Overnight Stay)

- Registration Fee

- Attach copy of registration form

- Attach original PAID receipt for registration fee

- Must be a Paid receipt

- If No Paid receipt

- Copy of credit card statement, or

- Copy of cancelled check (front and back)

- If registration paid on Purchase Order

- Note the $ amount paid and Requisition Number under “No Cost Reimbursement”

- If registration paid on PCard

- Note the $ amount paid and PCard (Month) under “No Cost Reimbursement”

- Tolls, Parking, etc.

- Attach original Paid receipt(s)

- If No receipt

- Complete Record of Lost Receipts: http://www.se.edu/office-of-finance/forms/

- A receipt is required for any single expense $25 or more

- Sign and date

- Complete Record of Lost Receipts: http://www.se.edu/office-of-finance/forms/

- Mileage – Google Maps website https://www.google.com/maps/ Name of Destination and physical address (Print and Attach) (Example: Southeastern Oklahoma State University to Grayson College to Southeastern Oklahoma State University)

- Google Maps print should include the entire trip

- Duty station to all destinations in order traveled to duty station

- Routing of Travel

- All travel performed for the state shall be by a direct travel route appropriate to the mode of transportation used

- When an employee for his/her own convenience travels by an indirect route or otherwise interrupts travel by direct route, the extra expense shall be borne by the employee

- If leaving from or returning to home during work week (Monday thru Friday) – The shorter of the distances from the employee’s residence or office location to the destination point(s) of travel would be considered the starting point of travel

- If home is shorter make notation in the mileage section -*home is shorter distance

- If leaving from or returning to home during weekend or holiday – Distances from the employee’s residence to the destination point(s) of travel would be considered the starting point of travel and/or ending point of travel

- Google Maps print should include the entire trip

In State Travel Reimbursement (Overnight Stay)

- Registration Fee

- Attach copy of registration form

- Attach original PAID receipt for registration fee

- Must be a Paid receipt

- If No Paid receipt

- Copy of credit card statement, or

- Copy of cancelled check (front and back)

- If meals were included in the registration fee, the number of meals provided should be indicated on the form and one-fourth of one day’s meal and incidental expense allowance should be deducted from the per diem for each meal provided. (Per Diem page 2)

- If registration paid on Purchase Order

- Note the $ amount paid and Requisition Number under “No Cost Reimbursement”

- If registration paid on PCard

- Note the $ amount paid and PCard (Month) under “No Cost Reimbursement”

- Tolls, parking, etc.

- Attach original Paid receipt(s)

- If No receipt

- Complete Record of Lost Receipts: http://www.se.edu/office-of-finance/forms/

- A receipt is required for any single expense $25 or more

- Sign and date

- Complete Record of Lost Receipts: http://www.se.edu/office-of-finance/forms/

- Telephone

- Telephone charges may be reimbursed when incurred conducting University business

- Memo of explanation must be attached

- Attach original Paid receipt

- Telephone charges may be reimbursed when incurred conducting University business

- Internet – Other Misc Costs

- Internet charges may be reimbursed when incurred conducting University business

- Memo of explanation must be attached

- Attach original Paid Receipt

- Internet charges may be reimbursed when incurred conducting University business

- Per Diem (page 2)

- Per Diem: Are you claiming per diem?

- Mark “Yes” or “No”

- If “Yes”

- Go to www.gsa.gov/perdiem use conference location zip code (Print and Attach)

- Documentation such as Brochure or Literature must be attached to verify per diem days allowable

- Verify Beginning and Ending Dates and Times of the Conference or Meeting

- Standard Travel Rule – Travel status shall not extend more than one calendar day before and/or more than one calendar day after the date and time of object of travel (e.g., meeting, workshop, conference, etc.) begins and/or ends (74 O.S. § 500.9.E).

- Verify Beginning and Ending Dates and Times of the Conference or Meeting

- Meals included in cost of registration

- The employee’s daily meals expense allowance shall be adjusted for each meal provided in the cost of registration

- Highlight meals included in registration fee

- Registration form generally lists meals included

- Exceptions to meal expense allowance adjustment

- Snacks, or refreshments, such as coffee, tea, soft drinks, etc., provided during meeting breaks DO NOT count as provided meal.

- Hors d’oeuvres DO NOT count as provided meal

- Meals provided by a third party that are not covered in the registration fee, package plan, or agency direct pay contract DO NOT reduce the per diem.

- Employee may opt to count as a meal if budget does not allow.

- Complimentary hotel breakfasts do not reduce the per diem unless provided through a conference registration.

- Per Diem: Are you claiming per diem?

- Lodging (page 2)

- Lodging: Are you claiming lodging?

- Mark “Yes” or “No”

- If “Yes”

- Attach original itemized Paid receipt for lodging expense

- No reimbursement for room service/food/movies

- Attach original itemized Paid receipt for lodging expense

- If “No” designated hotel conference rate

- Reimbursement is limited to per diem rate schedule (use lodging zip code)

- Go to www.gsa.gov/perdiem use conference location zip code (Print and Attach)

- Designated Lodging Rates

- Attach documentation such as Brochure or Literature indicating that this was a designated hotel/motel (single room rate specified on conference literature)

- A sponsor may arrange a meeting, workshop, or similar travel objective to be held at a host or headquarters lodging facility. In such travel instances and when the hotel or motel is specified by the sponsor’s announcement or notice (e.g., conference brochure), reimbursement may be allowed for the actual cost of lodging not to exceed the single occupancy room rate charge as indicated on the paid lodging receipt.

- Attach documentation such as Brochure or Literature indicating that this was a designated hotel/motel (single room rate specified on conference literature)

- Optional Lodging in Lieu of Designated Lodging (Host hotel)

- IF employee opts to use lodging besides the designated hotel at which the object of travel is conducted or held,

- Reimbursement for any incurred local transportation expenses (such as taxi, bus, rental car, private automobile mileage, etc.) for travel between the optional lodging location and the designated (host) lodging facility shall be allowed in an amount not to exceed the difference between the cost of the designated lodging and the cost of the option lodging

- Schedule of designated (host) hotel single room daily rate must be attached

- IF employee opts to use lodging besides the designated hotel at which the object of travel is conducted or held,

- Lodging: Are you claiming lodging?

- Mileage – Google Maps website https://www.google.com/maps/ physical address to physical address (Print and Attach)

- Google Maps print should include the entire trip

- Duty station to all destinations in order traveled to duty station

- Routing of Travel

- All travel performed for the state shall be by a direct travel route appropriate to the mode of transportation used

- When an employee for his/her own convenience travels by an indirect route or otherwise interrupts travel by direct route, the extra expense shall be borne by the employee

- If leaving from or returning to home during work week (Monday thru Friday) – The shorter of the distances from the employee’s residence or office location to the destination point(s) of travel would be considered the starting point of travel

- If home is shorter make notation in the mileage section -*home is shorter distance

- If leaving from or returning to home during weekend or holiday – Distances from the employee’s residence to the destination point(s) of travel would be considered the starting point of travel and/or ending point of travel

- Google Maps print should include the entire trip

Authorization for Out-of-State and International Overnight Travel

Airfare Paid on SE PCard

All overnight travel outside of Oklahoma $1,500 or more and All international travel outside United States must be approved by the President prior to travel and in advance of purchasing airline tickets to be paid by SE PCard. The approved Out-of-State Overnight / International Travel Request is authorization to book your airfare with All Seasons Travel Agency to be paid by SE PCard. All SE Airfare Paid on SE PCard will be booked through the Office of Finance by the Travel Specialist ext.2958.

Airfare may be booked by another agent (e.g., Online, other agency) only AFTER an Airfare Comparison has been received from All Seasons Travel and be approved by the Travel Specialist. Airfare reimbursement is limited to All Seasons Quote plus mileage to and from the airport – see last page of this document for allowable mileage to and from the airport. (Print and Attach copy of All Seasons quote to travel reimbursement claim form).

Airfare for Student Travel

All airfare for student travel along with sponsor travel should be started by obtaining a quote from All Season’s Travel. Once a quote is received, an email with the attached quote should be sent to the Travel Specialist requesting airfare. The email should include dates of travel, destination, names of students and sponsor(s) along with the account number the trip should be paid with.

Overnight Lodging and Per Diem (Meals) Expenses

Direct purchase of lodging facilities can be made by obtaining reservations directly with the facility and then processing a purchase order in the Colleague Self Service). The purchase order must be processed prior to the traveler’s departure and must include the following information: dates lodging will be required; name of individual(s) for whom lodging is to be provided; designated lodging rate; location; and purpose of trip.

If a hotel is designated by the conference, the actual rates will be paid, not to exceed single occupancy rate. Documentation must be attached from the conference indicating that this was a designated hotel. The single room rate must be specified on the conference literature.

If employee opts to use lodging besides the designated hotel at which the object of travel is conducted or held, reimbursement for any incurred local transportation expenses (such as taxi, bus, rental car, private automobile mileage, etc.) for travel between the optional lodging location and the designated (host) lodging facility shall be allowed in an amount not to exceed the difference between the cost of the designated lodging and the cost of the option lodging.

Reimbursement for other charges (internet/telephone) appearing on the hotel receipt must be justified in writing. The reimbursement should be included in the itemized “Miscellaneous Reimbursement Costs” section on the appropriate line.

Out-of-State Travel Instructions